Apply GST Registration Online

Apply GST Registration Online

- Same Day Process

- 100% Online, Safe & Secure Registration

- 10,000+ Happy Clients

- ISO Certified

Access comprehensive online support from India’s top Business Taxation Experts, guiding you through every step, from GST Registration to the annual filing of mandatory GST Returns.

Apply Now

Fill Up the below Mentioned Form

![]() Google Reviews 4.8/5

Google Reviews 4.8/5 ![]()

|| 3.1k+ Happy Reviews ||

GST or Goods and Service Tax is a kind of indirect tax for India and applicable on the supply of products and providing of services. It is a comprehensive and multi-staged assessing; comprehensive because it has subsumed all the indirect taxes except a few and multistage because it is implicated at every step within the generation prepare. It is supposed to be discounted to all the parties within various stages of generation except the ultimate consumer.

Yes! With the free GST Registration services, Online Legal India™ also provides three different packages to file the GST Returns on-time for the GST registered business individuals in India.

Yes, it is mandatory to pay GST for all the tax payers who is registered under GST regime.

The full form of CGST– Central Goods and Service Tax | SGST– State Goods and Service Tax | IGST– Integrated Goods and Service Tax

No, you don’t. Online Legal India looks after each and every procedure. You don’t need to visit any Govt. office. You just have to simply register on our official website and get your GST registration done at ease

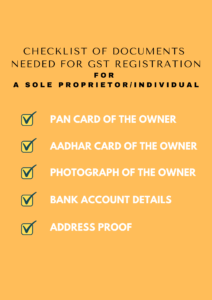

Aadhaar card

PAN of the Applicant(Proprietor)

Proof of business registration or Incorporation certificate

Identity and Address proof of Promoters/Director with Photographs

Address proof of the place of business

Bank Account statement/Cancelled cheque

Letter of Authorization/Board Resolution for Authorized Signatory

Rent Agreement in case the PPOB(Principal Place of Business) is rented

Goods and Services are categorized into five categories of tax slabs for collection of tax- 0%, 5%, 12%, 18% and 28%.

IN case of delay in GST filing, the penalty of Rs. 200/- is charged per day. There is no late fee charged in IGST.

When GST Return is not filed, then 10% of the due tax will be the penalty amount or Rs. 10000, whichever is earlier.

When someone commits fraud, then there will be a penalty which is 100% of the due tax or Rs. 10000 – whichever is earlier.

Once the GST Certificate is issued, the registration is valid until it is surrendered, cancelled or suspended. Only GST certificate issued to non-resident taxable person and casual taxable person have a limited validity period.

GST Registration Online - An Overview

Launched on 1 July 2017, the Goods & Services Tax (GST) applies to all Indian service providers (including freelancers), traders and manufacturers. A variety of Central taxes like Service Tax, Excise Duty, CST and state taxes like Entertainment Tax, Luxury Tax, Octroi, VAT are accumulated in the GST. Also, taxpayers with a turnover of less than ₹1.5 crore can choose a composition scheme to get rid of tedious GST formalities and pay GST at a fixed rate of turnover.

Every product goes through multiple stages along the supply chain, including purchasing raw materials, manufacturing, selling to the wholesaler, selling to the retailer and then the final sale to the consumer. Interestingly, GST will be levied on all of these 3 stages. Let’s say if a product is produced in West Bengal but is being consumed in Uttar Pradesh, the entire revenue will go to Uttar Pradesh.

Components of GST

The components of Goods and Services Tax (GST) in India are:

Central Goods and Services Tax (CGST)

This is levied by the central government on all intra-state and inter-state supplies of goods and services. The CGST rate is the same for all states and union territories.

State Goods and Services Tax (SGST)

This is levied by the state government on all intra-state supplies of goods and services. The SGST rate varies from state to state.

Integrated Goods and Services Tax (IGST)

This is levied by the central government on all inter-state supplies of goods and services. The IGST rate is the sum of the CGST and SGST rates.

Union Territory Goods and Services Tax (UTGST)

This is levied by the central government on all supplies of goods and services made within a union territory. The UTGST rate is the same as the SGST rate.

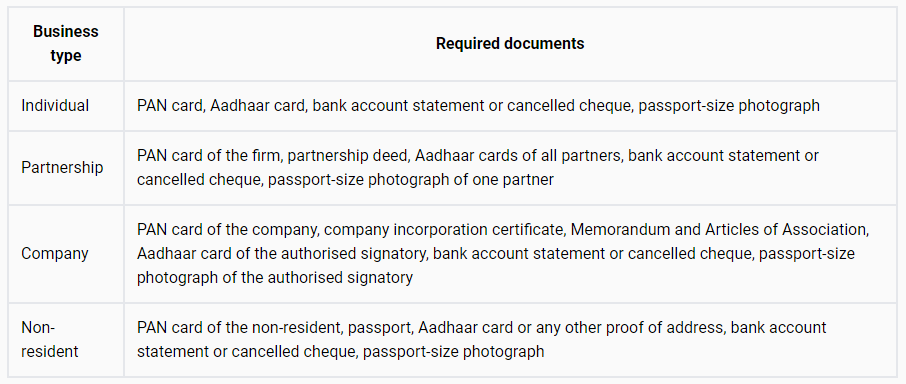

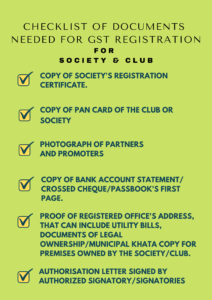

Documents Required For GST Registration

Type of GST Registration

Regular, sporadic, non-resident and e-Commerce operators are some of the different GST registration categories. Casual taxpayers, non-resident taxpayers, and e-Commerce enterprises must register for GST regardless of the turnover criteria.

CASUAL TAXABLE PERSONS

In accordance with the GST Act, a casual taxable person is defined as an individual or entity that sporadically provides goods or services in a State or Union territory without a fixed establishment. This category includes individuals engaged in mobile businesses, such as those operating at events or seasonal activities, as per GST regulations.

NON-RESIDENT TAXABLE PERSONS

A non-resident taxable person is any person, corporation, or organisation that offers goods or services subject to the GST but does not have a permanent place of business or habitation in India (NRI). Because of this, any foreign person, business, or organisation that provides goods or services to India would be regarded as a non-resident taxable person and would have to follow all applicable GST legislation in India.

E-COMMERCE OPERATORS

A non-resident taxable person is any person, corporation, or organisation that offers goods or services subject to the GST but does not have a permanent place of business or habitation in India (NRI). Because of this, any foreign person, business, or organisation that provides goods or services to India would be regarded as a non-resident taxable person and would have to follow all applicable GST legislation in India.

CHARGES

GST Registration

Only Registration-

Application filing for GSTIN

-

Generate ARN & TRN number

-

Call, Chat, Email Support

-

Personally assigned GST Expert

GST Registration

+ 3 Months return Filing-

GST Registration absolutely FREE

-

GST Return Filing for 3 Months

-

Call, Chat, Email Support

-

Personally assigned GST Expert

GST Registration

+ 6 Months Return Filing-

GST Registration absolutely FREE

-

GST Return Filing for 6 Months

-

Call, Chat, Email Support

-

Personally assigned GST Expert

Why Choose Us?

Happy Customers Across India

Trained & Professional Experts

MSME Registered

On Time Service

Frequently Asked Questions (FAQs)

GST has three tax components, namely:

- Central Goods and Services Tax or CGST, it is a central government

- State Goods and Services Tax or SGST which is a state component. Where centre and state will levy GST on all entities for all the transaction in the state

- The Integrated Goods and Services Tax (IGST), to be levied by the centre, i.e. when a transaction happens from one state to another.

The list of documents required for registration of GST for various business are as follows:

- PAN Card and address proof of proprietor

- Partners’ names and address proof

- Identity and address proof of directors

- If any further documents require then our expert will guide you

- Passport

- Voter Identity Card

- Aadhar Card

- Ration Card

- Telephone or Electricity Bill

- Driving License

- Bank Account Statement

Add what works as identity proof, One can use a Pan card, Aadhar Card as identity proof. For address proof, any of the director’s can show their voters ID, passport, telephone bill, electricity bill and telephone bill.

Step 1: To apply GST Registration Online, visit the GST Registration portal and select ‘New GST Registration’

Step 2: Fill in the necessary details like name of business, state, pan card details, etc

Step 3: Enter the OTP and click proceed

Step 4: Make a note of the Temporary Reference Number(TRN)

Step 5: Check the GST Registration portal and select ‘Register’ in the ‘Taxpayers’ menu

Step 6: Enter the TRN and proceed

Step 7: Enter the OTP received on your registered mobile number or your email and then proceed

Step 8: You can check the status of your application on the next page

Step 9: Fill in the necessary details and upload the necessary documents

Step 10: Submit your application after verifying by one of the three methods given

Step 11: After completion, you will receive the Application Reference Number(ARN) on your registered mobile number and email id

Step 12: Now you can access the status of the ARN on the GST portal.

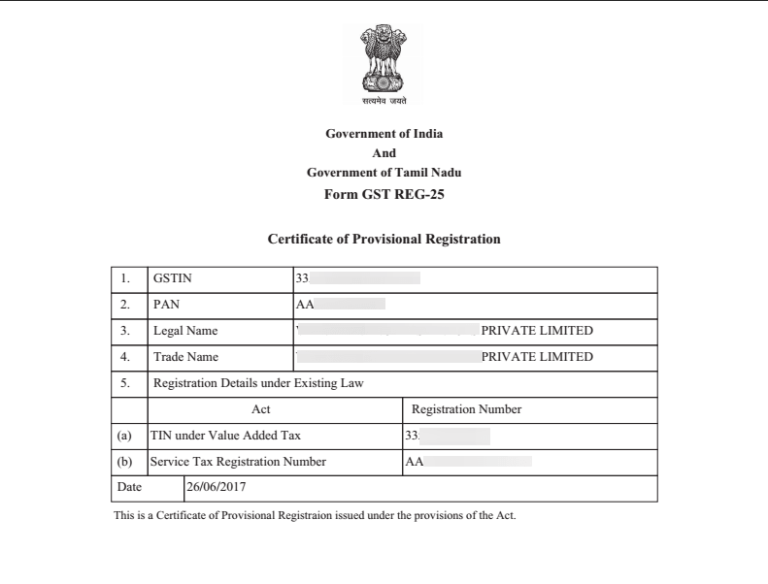

After successful registration, you will get your GST registration certificate and GSTIN after verification of the GST application and other mandatory GST registration documents by the GST officer. Be aware that no hard copies of the certificate will be issued and the GST certificate can be downloaded from the GST Portal.

- Any individual or business entity that carries out taxable supplies of goods or services

- Annual turnover of the business exceeds the prescribed threshold limit (currently ₹20 lakhs for most businesses)

- E-commerce operators that facilitate the supply of goods and services through their platform

- Non-resident taxable persons who occasionally supply goods or services in India

- Businesses that are involved in inter-state supply of goods or services

- Input service distributors who distribute input tax credit to their branches or units

- Casual taxable persons who supply goods or services occasionally in India

- Businesses that were previously registered under the old tax regime (VAT, Service Tax, etc.) and have migrated to GST.

A GST Registration Certificate is a document issued by the Indian government to businesses registered under the Goods and Services Tax (GST) system. It serves as proof of the business’s registration under GST and includes details such as the business’s GST identification number, name, and address. Businesses are required to have a GST Registration Certificate to be able to charge and collect GST from customers. It is also used for various other purposes such as availing input tax credits, applying for loans and participating in tenders.

Goods and Services Tax (GST) is a value-added tax that is levied on the supply of goods and services in India. The GST tax rates in India are as follows:

- 0% – This rate is applicable for essential items such as food grains, fresh vegetables, and medical supplies.

- 5% – This rate is applicable for items such as processed food, packaged food, and some household items.

- 12% – This rate is applicable for items such as mobile phones, laptops, and television sets.

- 18% – This rate is applicable for items such as air conditioners, refrigerators, and washing machines.

- 28% – This rate is applicable for items such as luxury cars, tobacco, and aerated beverages.

In addition to these rates, there are some special rates that are applicable to specific goods and services. For example, gold is taxed at 3%, while crude oil and natural gas are taxed at 6%. GST Registration is also levied on services such as telecom, insurance, and banking at the rate of 18%.

It’s important to note that GST rates are subject to change and may vary depending on the type of goods or services being supplied. It’s always a good idea to check the current GST rates before making a purchase or offering a service.

Check out the GST calculator, which comes in handy to calculate the Goods and Service Tax using different slabs.

GSTIN is a unique identification number given to each GST taxpayer. To verify a GSTIN number, a person who has a GST number can log onto the GST portal.

The Goods and Service Tax Network (or GSTN) is section 8 (non-profit), non-government, private limited company. GSTN is a one-stop solution for all your indirect tax requirements. GSTN is responsible for maintaining the Indirect Taxation platform for GST to help you prepare, file, rectify returns and make payments of your indirect tax liabilities.

As per the Section 122 of the CGST act, in India, there is a direct penalty for all those taxable persons who fail to register for GST online.

Any small business with turnover less than ₹ 20 lakh can voluntarily register for GST even though it is not compulsory by law. Voluntary GST registration has its own advantages and some of them are:

- Take input credit: In GST Registration, there is a flow of input credit right from manufacturers of the goods to the consumers across the country. Input credit means a taxpayer while paying tax on output, can deduct the tax that has already been paid on inputs and pay only the remaining amount. Voluntarily registered businesses can increase their margins and profits through this

- Do inter-state selling with no restrictions: SMEs can increase the scope of their businesses and find prospective customers and explore online platforms

- Register on e-commerce websites: SMEs can widen their market by registering through e-commerce sites

- Have a competitive advantage compared to other businesses.

WHY US

We track customer satisfaction by asking the clients to share their HAPPY REVIEW with our agents only if they are generally pleased with our services. Since we are a customer-centric company always prioritizing the success of our clients, the HAPPY REVIEW program helps us to gauge the customers’ happiness and loyalty in our products or services.

We Are In The News

Trustindex verifies that the original source of the review is Google. Trustindex verifies that the original source of the review is Google. Great experienceTrustindex verifies that the original source of the review is Google. goodTrustindex verifies that the original source of the review is Google. I taken fssai license very smooth and Hassle free proces, kudos team LZITrustindex verifies that the original source of the review is Google. Trustindex verifies that the original source of the review is Google. Legal zone india is a very supportive platform for any person who starts new business i am sharing my personal experience animesh was the guy who support to do apply my fssai licence Ptax they have very good patience to handle client even I also don't know anything but the guy Animesh who guided me properly and do my work very clearly i thank legal Zone India team and specially Animesh who handled my work properly i will sure100% to refer to any person. Thank you Animesh & legal zone india team🙏🏻👍🏻Trustindex verifies that the original source of the review is Google. Dese guys are really wonderful and professional.. Thanx to the legal zone for outstanding service ... Thanx a ton guys stay blessedTrustindex verifies that the original source of the review is Google. Sauch a great experience with legal zone indiaTrustindex verifies that the original source of the review is Google. Trustindex verifies that the original source of the review is Google. Load more

About Us

Legal Zone India, owned by Legus Enterprise, is a registered partnership firm, which is specialized in providing legal help and providing people legal information just in their hands to easily use it.

Our core team consists of skilled and proficient qualified Advocates, along with a diligent team of other professionals, all under one roof. They provide solution to all the individual, business person, corporate body and others to get better help for the issues faced by them in their everyday life.

- Start-up

- MSME-UDYAM Registration

- Proprietorship Registration

- One Person Company Registration

- Digital Signature Certificate

- TAX & Compliances

- GST Registration

- GST Return Filing

- GST Modifictation

- GST-LUT

- GST Cancelation

Legal Zone India is a part of Legus Enterprise. Which is a Partnership registered firm & Registered under MSME Govt of India

- Disclaimer

- This is not a Government run Website and the form is not the actual registration form, it is just to collect information from our clients so that our expert can easily understand their business or needs. By proceeding forward with this website you are aware that we are a private company managing this website and providing assistance based on the request from our customers and the fee collected in this website is a consultancy fee.

For any grievance mail to: info@legalzoneindia.com

Copyrights 2019 – 2025 Legal Zone India.

Refund Policy – Privacy Policy – Terms and Conditions